- Education

- Introduction to Trading

- Factors Affecting Oil Prices

Factors Affecting Oil Prices

Despite the development of renewable energy production, fossil fuels still make up the majority of the world's energy consumption, and oil is the most used source of energy.

Crude oil is a highly traded commodity. As for commodities, the oil market is as liquid as possible. When so many people around the world are trading in oil, why not do it? Crude oil can be traded with the help of online brokers and exchanges. They offer several financial instruments that allow you to speculate on the price of oil: shares of oil companies, CFDs, EFTs, Futures and Options.

There are many factors that have a heavy hand in the reasons why crude oil prices rise and fall, all in all there are many reasons why crude oil prices remain volatile year in and year out. So let's explore them

Oil is a very volatile instrument for trading, moreover, here we will often see protracted trends. Quite rarely, the price of oil is in the side corridor, and during moments of global crises, there are strong collapses in prices due to a drop in demand for "black gold". Risks will always be associated with high volatility, you need to think through your trading and be very strict about limiting losses.

KEY TAKEAWAYS

- There are many factors that have a heavy hand in the reasons why crude oil prices rise and fall, all in all there are many reasons why crude oil prices remain volatile year in and year out.

- Crude oil is a highly traded commodity. As for commodities, the oil market is as liquid as possible.

- Trading crude oil is no different from trading currencies or stocks. There are strong external factors that can put serious pressure on the price of oil.

Factors Affecting Oil Prices

Climate Factors

Weather conditions also have an impact on the oil market. As a rule, the end of summer for mining companies in the US can bring negative information in the form of impending hurricanes. The peak of these natural disasters falls at the beginning of autumn, which affects the work of mining companies. Due to this, companies reduce production, partially stopping the operation of fields, which reduces the supply of oil on world markets and pushes prices up.

Quotas for oil production from OPEC

Due to the reduction in oil production under the agreements that take place at OPEC meetings, commodity prices are rising. The goals of the organization are precisely the maintenance of stable oil prices. There was a time when Saudi Arabia and Russia could not agree at the next meeting of OPEC, there was a collapse in oil prices.

This is how the market reacted to the price war between countries and the unwillingness to cut production. However, in the future, the countries came to an agreement and there is every chance for the beginning of a bullish trend in oil.

Demand and Supply Factors Affecting Oil Prices

There is an opinion that it is data on demand that can form market trends, however, there is not so much high-quality data on consumption and shortage of oil. There are statistics from OPEC and from Baker and Hughes. However, it is clear that if the world needs oil and production is growing, then prices will move up.

In 2020 and 21, due to the pandemic and the general state of the global economy, they provoked a decrease in production and consumption around the world, which led to lower prices. As soon as the market returned to normal, prices began to rise qualitatively due to increased demand for raw materials.

The law of supply and demand also plays an important role in oil price fluctuations.

Demand refers to the amount of oil consumers want and how much they will pay for it.

Supply refers to how much oil is available for distribution to consumers. So, what contributes to the ups and downs of the supply and demand cycle?

High supply plus low demand results in a lower price.

Namely:

With a large supply of oil, the price decreases. When the price falls, demand starts to rise because consumers want more of the good at a lower price.For example, when there is an excess of oil, companies will cut prices to help sell their reserves. As soon as consumers see prices drop, they start demanding more.

Then there is a surge in demand.

Low supply plus high demand results in a higher price.

When demand for oil exceeds supply, supply begins to decline. When there is not enough supply to meet consumer demand, prices begin to rise again. As prices rise, demand begins to decline. Consumers will not want to pay higher oil prices.

For example, during the summer months, the number of trips to the US peaks. This increase in demand will reduce the supply of oil and drive up prices as more Americans need gasoline for their travels.

And last but not least, balance.

Essentially, the goal is to balance supply and demand. When equilibrium is reached, this means that supply equals consumer demand, which creates stable oil prices.

Seasonal Demand

Seasonal changes have a significant impact on crude oil prices. For example, in the summer when people travel, prices tend to go up. In addition, the peak of the hurricane season is in August and September, which can lead to higher oil prices.

According to the Clean Air Act, different fuels must be used at different times of the year.

Cars and trucks use a gasoline blend in winter to help them start more easily in cold temperatures. However, if winter gasoline is used in summer, it emits more emissions.

Why? Because there is more smog and ozone in summer than in winter, which leads to an increase in pollutants that can harm our lungs. When it is hot outside, the winter gas mixture does not burn completely, releasing pollutants into the air that threaten both the environment and the people who inhabit it.

Change in U.S. crude oil inventories from EIA

Every Wednesday, the EIA United States Crude Oil Stocks Change publishes data on changes in oil stocks, which has a strong impact not only on oil prices, but also on the US dollar. In the event of a strong inventory build, which we saw in April 2020, prices reacted lower and remained under pressure until inventories began to decline.

Rising inventories mean reduced demand, which puts pressure on the price of raw materials and quotes are declining. Falling inventories indicate potential purchases of oil to fill storage to the desired levels, which in turn pushes prices up.

If you want to learn more about “How to trade oil”, we recommend reading this article.

Geopolitical Factors

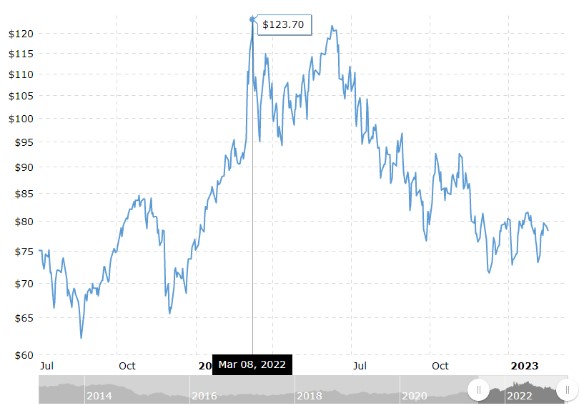

Various military conflicts can also put strong pressure on the price of oil. At the beginning of 2022, during the escalation of tension between Russia and Ukraine, and later on the war, Brent oil prices, WTI soared above $123 per barrel.

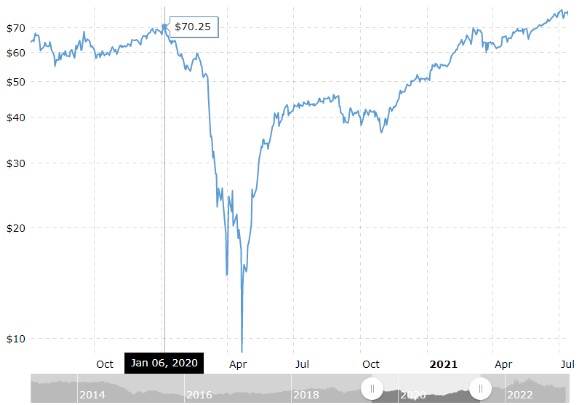

Also, for example, not so long ago, aggravations between Iran and the United States, Brent oil quotes rose above $ 70 per barrel. This event occurred against the backdrop of an attack by Iran on American facilities, which indicated potential problems with oil production and delivery, which in turn pushed prices up on expectations of a fall in the supply of "black gold" on the world market.

From charts above: wti oil price chart, brent crude oil price chart you can clearly see price movements throughout those time periods.

Bottom Line on Factors Affecting Oil Prices

Trading crude oil is no different from trading currencies or stocks. There are strong external factors that can put serious pressure on the price of oil. As in the currency market, news can push the market, you just need to follow the events in the world. Through CFD trading, the investor gets the opportunity to fully trade Brent or WTI oil with leverage and small contracts that do not require large financial investments and allow you to earn on oil.

The commodities market is subject to high volatility, so a simple oil trading system can give good profits in moments of strong movements, which will happen quite often. However, do not forget about money management and control the risks of such trading as much as possible.