- Education

- Learn to Trade Crypto

- What is Leverage in Crypto Trading

What is Leverage in Crypto Trading

Leverage in Crypto Trading

Leverage in crypto trading refers to using borrowed funds to make trades, in order to profit bigger. In other words, leverage is here for traders to amplify their buying or selling power. So when traders initial capital is small, they can use it as collateral to make leveraged trades.

But don't forget about the risk that leverage bears with it in crypto markets, as you know they are very volatile and sometimes quite unpredictable.

To better understand how leverage works in the crypto market, you first need to know What is Crypto Market.

Keep in mind that using leverage on its own is risky.

KEY TAKEAWAYS

- Leverage in crypto trading refers to using borrowed funds to make trades, in order to profit bigger.

- The higher the leverage the higher the risks of getting liquidated.

- In the crypto market before deciding on using leverage your trade should be backed up from both technical and fundamental aspects then and only then executed.

Leverage Crypto Meaning

As we mentioned earlier, leverage refers to using lended money to trade cryptocurrencies to amplify your buying or selling power so you can trade with more capital than what you currently have in your wallet. And depending on crypto exchange, you could have leverage up to 1:100 or even more.

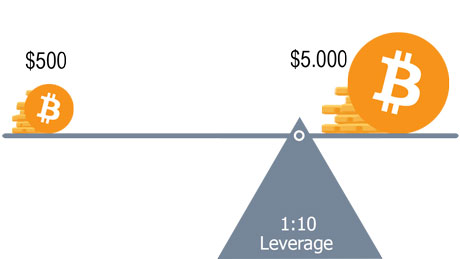

To clear it up, for example, if you have $100 and want to open a position worth $1000 let's say in Bitcoin - with 1:10 leverage you can achieve it.

How does Leverage Trading Work in Crypto

Before understanding leverage in crypto trading, you will need to fund your trading account, the initial capital you provide is called collateral. Depending on the leverage you choose and the total value of the position you wish to open, the required collateral varies.

Leverage Trading Crypto Example

Let's say you've decided to invest $5,000 in Bitcoin with 1:10 leverage, in this case the required margin would be the 1/10 of the $5000, which amounts to $500 - a collateral for the borrowed funds. The higher the leverage the lower the required margin - with 1:40 leverage for the same worth position ($5000), the margin will be $5000/40 which is $125.

This was the best part, now the fly in the ointment - the higher the leverage the higher the risks of getting liquidated, meaning you will need to maintain the margin threshold for your trades, and if, for example you decide to go long but the market moves against your position, and the margin falls below the maintenance threshold (also known as the maintenance margin) your funds will be liquidated unless you put more funds into your account.

Leverage obviously can be applied to both long and short positions. In case you don't know, opening a long position means that you expect the price of an asset to go up and vice versas when opening a short position.

When to use leverage

All successful traders make use of leverage and they risk different sizes depending on the opportunities. You should use leverage only when there is no-brainer opportunity in the market, when you are absolutely comfortable entering the market with a bigger position.

In the crypto market before deciding on using leverage your trade should be backed up from both technical and fundamental aspects then and only then executed.

To sum up, leverage is not something you should fear or use randomly, it's the most powerful weapon you have as a trader if you use it correctly.

Bottom Line on What is Leverage in Crypto Trading

Leverage makes it easy for you to get started with less initial capital and the potential for higher returns. However, leverage coupled with market volatility can lead to a quick liquidation, especially if you use 1:100 leverage to trade. Remember to always trade with caution and assess risk before trading with leverage.

Never trade funds that you cannot afford to lose, especially when using leverage.

There is no need to be afraid of leverage once you learn how to manage it. The only time you should not use leverage is if you are a laissez-faire trader. Otherwise, leverage can be used successfully and profitably with proper management. Like any sharp instrument, leverage must be handled with care - once you learn how to do it, you have nothing to worry about.

Lower leverage applied to each trade gives more breathing room by setting a wider but sensible stop and avoiding a higher capital loss, since high leverage trade can quickly drain your trading account if it goes against you as you will incur large losses due to large lot sizes. Keep in mind that the leverage is completely flexible and is customizable to suit the needs of each trader.

Crypto FAQs

What is Cryptocurrency Trading?

Cryptocurrency trading is the exchange of digital currency between traders. The fluctuations caused by supply and demand allow traders to profit from it. Cryptocurrency trading is both risky and rewarding due to its volatility.

How to Trade Cryptocurrencies?

You’ll need to open an account with a crypto brokerage company. The next step is to choose a trading platform. After that choose crypto to invest in and strategy to trade with. Final step is to store your cryptocurrency.

Can you Trade Crypto 24/7?

Yes. Cryptocurrency markets are open 24 hours a day, 7 days a week all year round. Traders have the opportunity to buy and sell without restrictions as the cryptocurrency markets do not close.

What are Most Traded Cryptos?

These are the 5 most traded cryptos all over the world

- Bitcoin - Market cap over $846 billion

- Ethereum - Market cap over $361 billion

- Tether - Market cap - over $79 billion

- Binance Coin - Market cap - over $68 billion

- XRP - Market cap - over $37 billion

What is Cryptocurrency Market?

Cryptocurrency is a form of decentralized currency and It's a completely digital asset. At its core, cryptocurrency uses blockchain technology to generate code segments that are unique for each transaction, just like serial numbers. Every time cryptocurrencies exchange hands, code segments are written to a decentralized ledger.