- Analytics

- Market Sentiment

WEEKLY TOP GAINERS/LOSERS: 23.05.2018

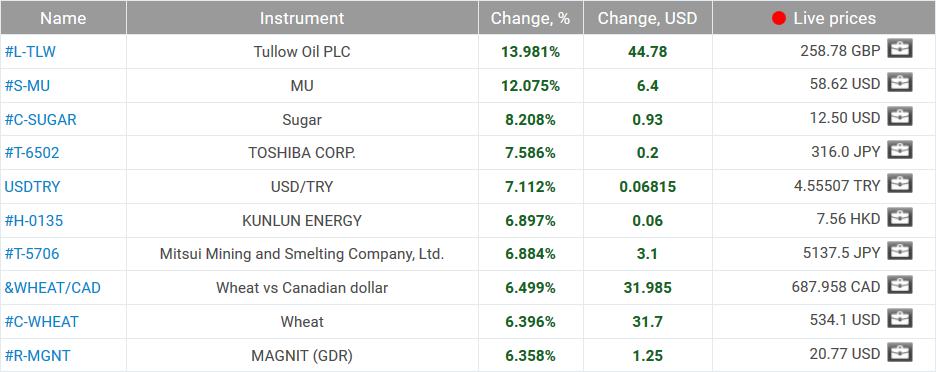

Top Gainers – The World Market

Top Gainers – The World Market

1. Tullow Oil – – stock prices of the company rose together with world oil prices. The investment bank Morgan Stanley raised forecasts of Tullow Oil’s financial performance. On Wednesday, its stock prices fell. The new president of Peru has canceled several oil production contracts of this company on the Peruvian shelf.

2. Micron Technology – stock prices of the memory card manufacturer have been rising since the beginning of May due to good earnings reports for the 1st quarter of 2018. The noticeable growth over the week was caused by the company's plans to buy back its own stocks for $10 billion. Another positive factor was the success in developing a new technology 3D NAND.

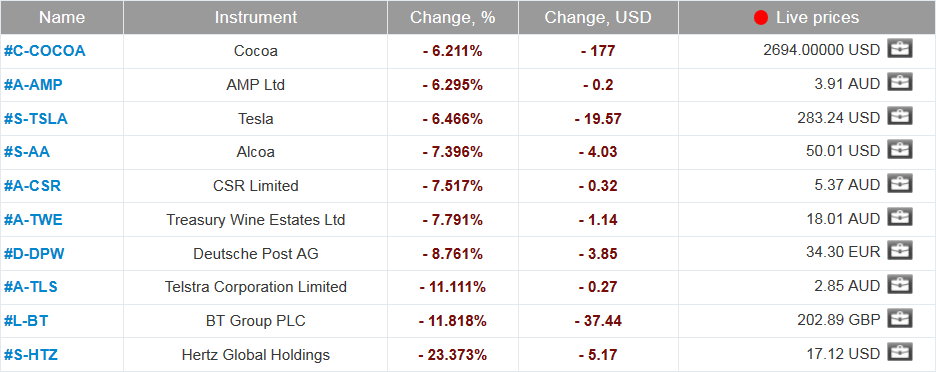

Top Losers – The World Market

Top Losers – The World Market

1. Tesla Motors – stock prices of the company fell after the authoritative magazine “Consumer Reports” reported issues in the braking control system of the new electric vehicle Model 3.

2. Ausnet Services – stock prices of the Australian energy company are falling after the publication of earnings reports for the fiscal year ending on March 31, 2018 and decisions on payments to shareholders. Profits per stock increased by 14%, and the expected dividends - only by 5%.

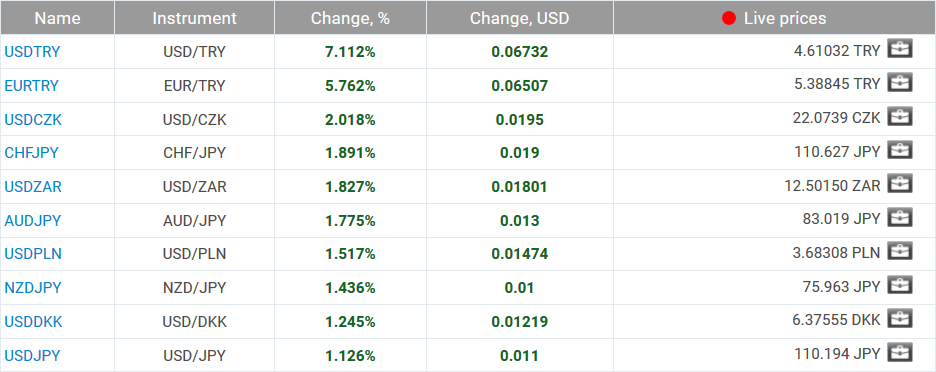

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. USDTRY, EURTRY - The Turkish lira has been falling against the US dollar and the euro for the 4th consecutive week. On the chart it looks like a growth. On June 24, 2018, early presidential and parliamentary elections will be held in Turkey. Current President Tayyip Erdogan stands for strengthening control over the economy. Investors were afraid of lower rates. With the aim to support the exchange rate, the Central Bank of Turkey raised the rate to 16.5% on May 23. It is possible that the weakening of the lira will cease, since inflation in the country is much lower. In May, it was 10.85% year over year.

2. USDCZK - the Czech koruna collapsed amid the strengthening of the US dollar. On the chart it looks like a growth. In addition, statements of the representatives of the Czech National Bank that the Czech economy is experiencing strong inflationary pressures had a negative impact. This reduces the likelihood of an early rate hike. Let us recall that at the regular meeting on May 3, the Czech Central Bank kept the rate at 0.75%, while the majority of market participants expected its growth by 0.25%.

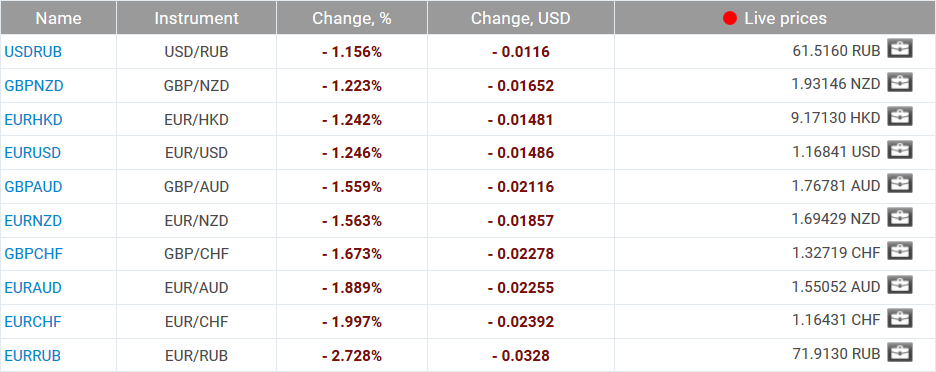

Top Losers - Foreign Exchange Market (Forex)

Top Losers - Foreign Exchange Market (Forex)

1. USDRUB - the Russian ruble strengthened against the US dollar amid high world oil prices. The share of energy raw materials in Russian exports is 65%.

2. GBPNZD - The New Zealand dollar strengthened due to an increase in the government forecast of the budget surplus for the current fiscal year to NZ $3.14 billion. However, on Wednesday, it again fell after the report by the Reserve Bank of New Zealand on the beginning of the money emission and the launch of the quantitative easing program. In turn, the British pound showed the highest daily decline in 2018 after the publication of data on the decrease in inflation in April. Now investors doubt that the Bank of England will raise rates in the foreseeable future.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...