- Analytics

- Technical Analysis

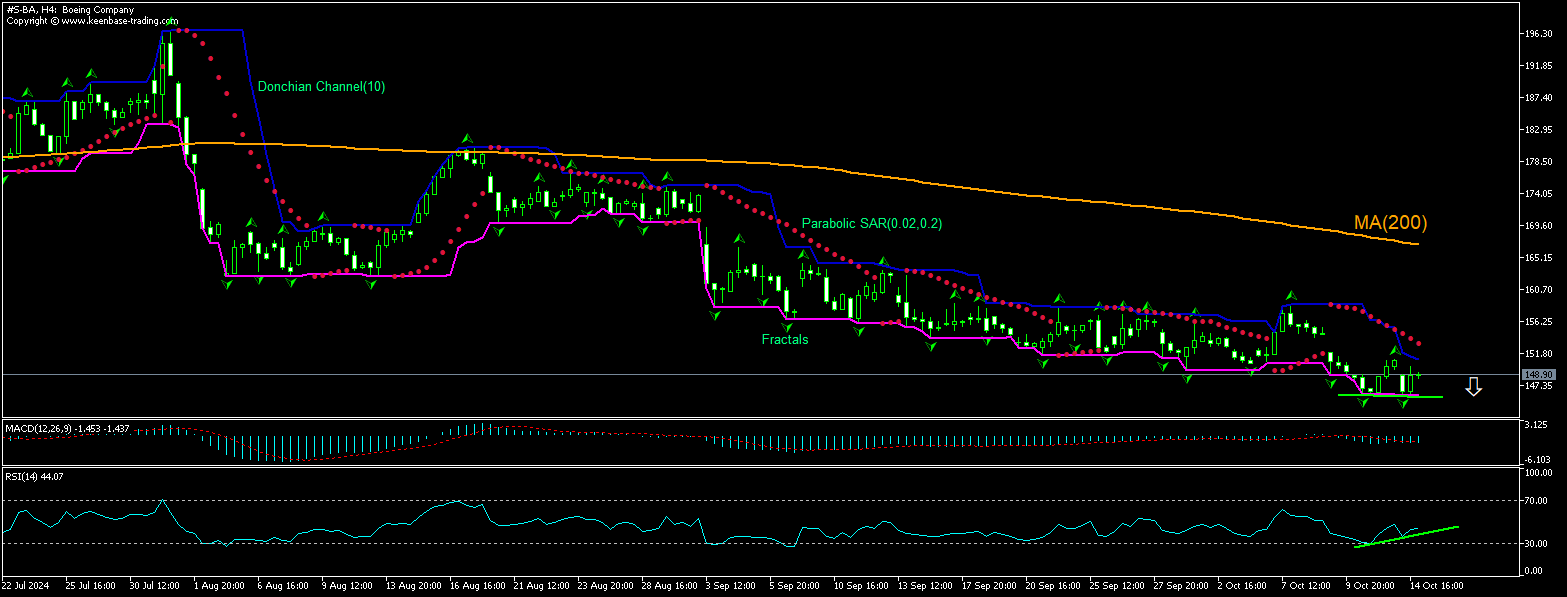

Boeing Technical Analysis - Boeing Trading: 2024-10-15

Boeing Technical Analysis Summary

Below 145.90

Sell Stop

Above 150.94

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Boeing Chart Analysis

Boeing Technical Analysis

The technical analysis of the Boeing stock price chart on 4-hour timeframe shows #S-BA,H4 is retracing down under the 200-period moving average MA(200) after testing the MA(200) six weeks ago. The RSI indicator has formed a bullish divergence. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 145.90. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 150.94. After placing the order, the stop loss is to be moved every day to the next fractal high indicator following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (150.94) without reaching the order (145.90), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Boeing

Boeing stock closed down yesterday after reports thousands of Boeing staff will get layoff notices within weeks. Will the Boeing stock price retreating persist?

Roughly 33,000 Boeing workers have been on strike since September 13, seeking a 40% wage increase over four years. The plane maker plans for 10% reductions at its commercial unit involving both union and non-union workers. Boeing will send out 60-day notices to thousands of workers next month including many in its commercial aviation division, meaning those staff will leave the company in mid-January. A second phase of notices, if needed, could be issued in December. Layoff news followed company's surprise after-hours job cut announcement on Friday, which also included a new delay to the 777X jetliner and the ending of civil 767 freighter production. The one-year delay in 777X deliveries to 2026 was widely expected, but spurred concerns that the company would have to find fresh funding to overcome the financial distress. Emirates Airline President Tim Clark commented that the company faced a risk of an imminent investment downgrade with Chapter 11 looming on the horizon "unless the company is able to raise funds through a rights issue.” Ratings agency S&P has warned Boeing risks losing its prized investment-grade credit rating. Most analysts expect Boeing to raise up to $15 billion through a share issue. Forced layoffs as Boeing faces further plane delivery delays is bearish for stock price.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.