- Analytics

- Technical Analysis

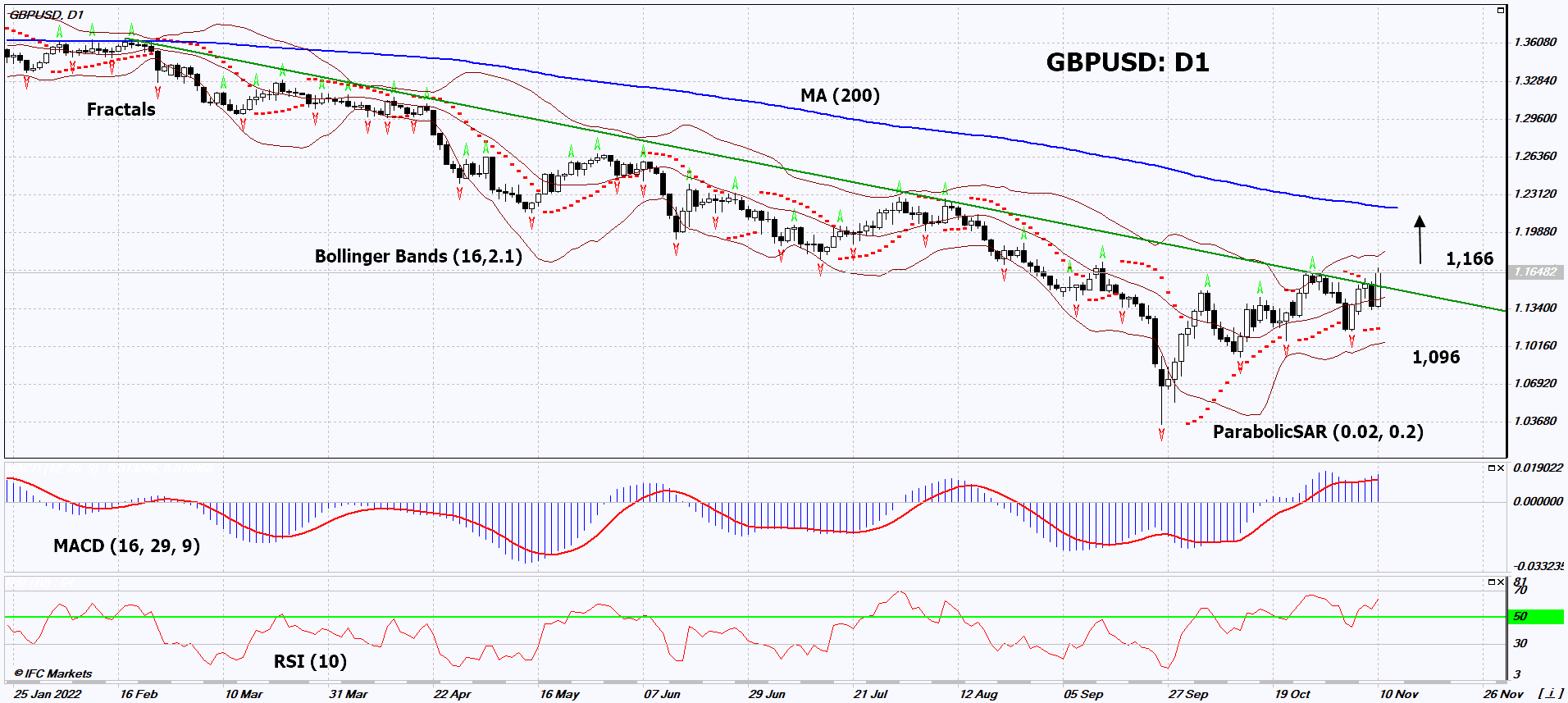

GBP/USD Technical Analysis - GBP/USD Trading: 2022-11-11

GBP/USD Technical Analysis Summary

Above 1,166

Buy Stop

Below 1,096

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

GBP/USD Chart Analysis

GBP/USD Technical Analysis

On the daily timeframe, GBPUSD: D1 has exceeded the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if GBPUSD: D1 rises above its most recent high of 1.166. This level can be used as an entry point. Initial risk cap is possible below the Parabolic signal, the lower Bollinger band and the last 2 lower fractals: 1.096. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a trade, can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (1.096) without activating the order (1.166), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - GBP/USD

Investors do not rule out a slowdown in the growth rate of the Federal Reserve (Fed) after the publication of the United States Consumer Price Index. Will GBPUSD quotes continue to rise?

The upward movement of the chart means the weakening of the US dollar against the British pound. In October, US inflation amounted to +0.4% m/m. This is less than expected (+0.6% m/m). Now the probability of a Fed rate hike of 0.5% has exceeded 80%, while a week earlier it was only 52%. Prior to this, the American regulator raised the rate by 0.75% four times in a row and now it is 4%. Note that the annual inflation in the US in October was 7.7%. This is the minimum since January of this year +7.5% y/y. The current Bank of England (BoE) rate is 3% with inflation of 10.1% y/y in September. On November 16, the United Kingdom Consumer Price Index for October will be released. If it turns out to be positive. This may help strengthen the British pound. In general, Britain is expected to publish a large number of important economic indicators, which can also affect the dynamics of the pound. November 11 will be released preliminary GDP for the 3rd quarter and GDP for September and November 15 - data on the British labor market.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.