- Analytics

- Technical Analysis

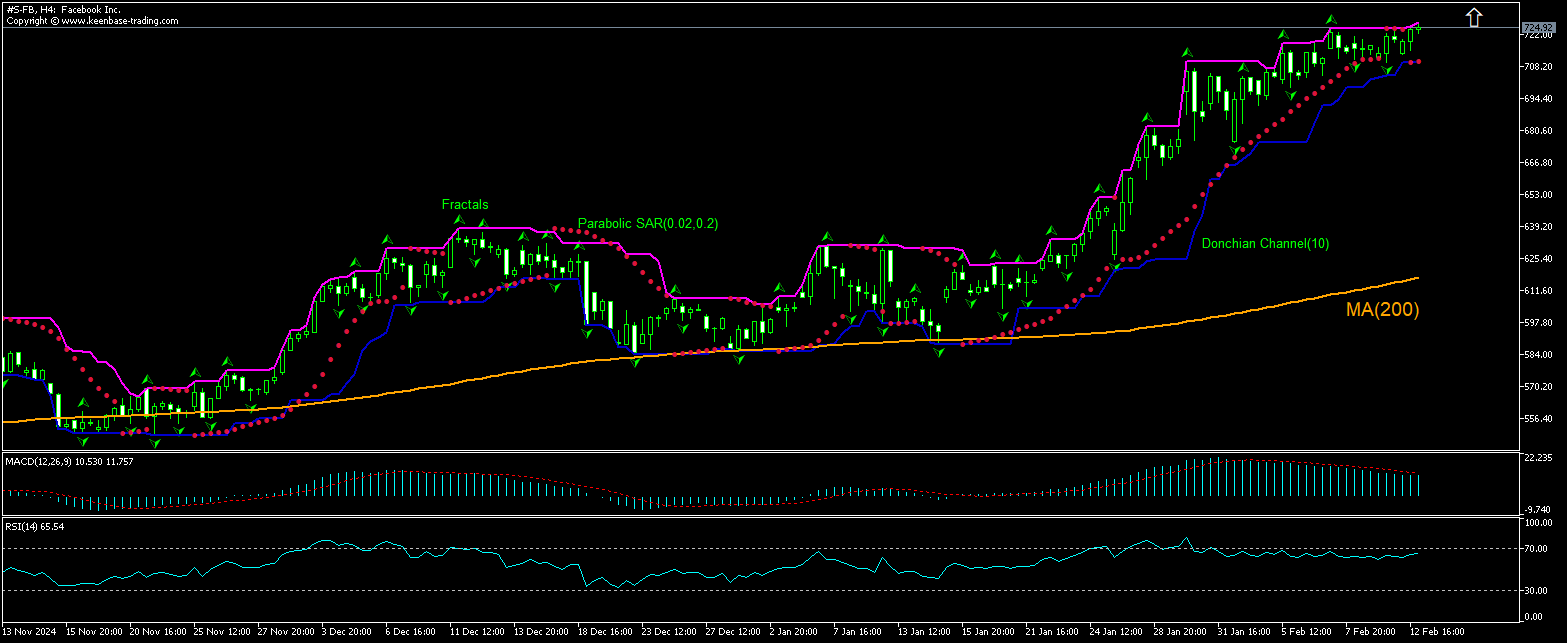

Meta Platforms Inc. Technical Analysis - Meta Platforms Inc. Trading: 2025-02-13

Facebook (Meta Platforms Inc.) Technical Analysis Summary

Above 726.79

Buy Stop

Below 709.87

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

Facebook (Meta Platforms Inc.) Chart Analysis

Facebook (Meta Platforms Inc.) Technical Analysis

The technical analysis of the Facebook stock price chart on 4-hour timeframe shows #S-FB,H4 closed at all-time high last session above 200-period moving average MA(200) which is rising itself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 726.79. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 709.87. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (709.87) without reaching the order (726.79), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Facebook (Meta Platforms Inc.)

Facebook’s stock closed up yesterday before news Tigress Financial raised its Meta Platforms price target. Will the Facebook stock price continue advancing?

Stock of Meta Platforms, Inc., the Facebook parent, ended 0.78% higher on Wednesday before reports Tigress Financial raised the firm’s price target on Meta Platforms to $935 from $645 and kept a “Strong Buy” rating on the shares. The company wrote that the raised 12-month target of $935 amounts to a potential return with dividends of over 30% from current levels. It views Meta as having “tremendous AI-driven opportunities” for personalized AI-driven functionality across its platform of apps, and sees “significant upside,” driven by the ongoing potential to monetize many of its critical applications and technologies, including Instagram, Messenger, and WhatsApp. A company share price target upgrade is bullish for the stock price. Before the price target upgrade news Meta began notifying staff of job cuts on February 10. The layoffs will be affecting almost 4,000 Meta workers across the United States, Europe, and Asia. Chief Executive Officer Mark Zuckerberg told employees that Meta would cut 5% of its workforce, particularly those who “aren’t meeting expectations” while telling managers that the cuts would help make space for the company to hire the “strongest talent.”

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.