- Analytics

- Technical Analysis

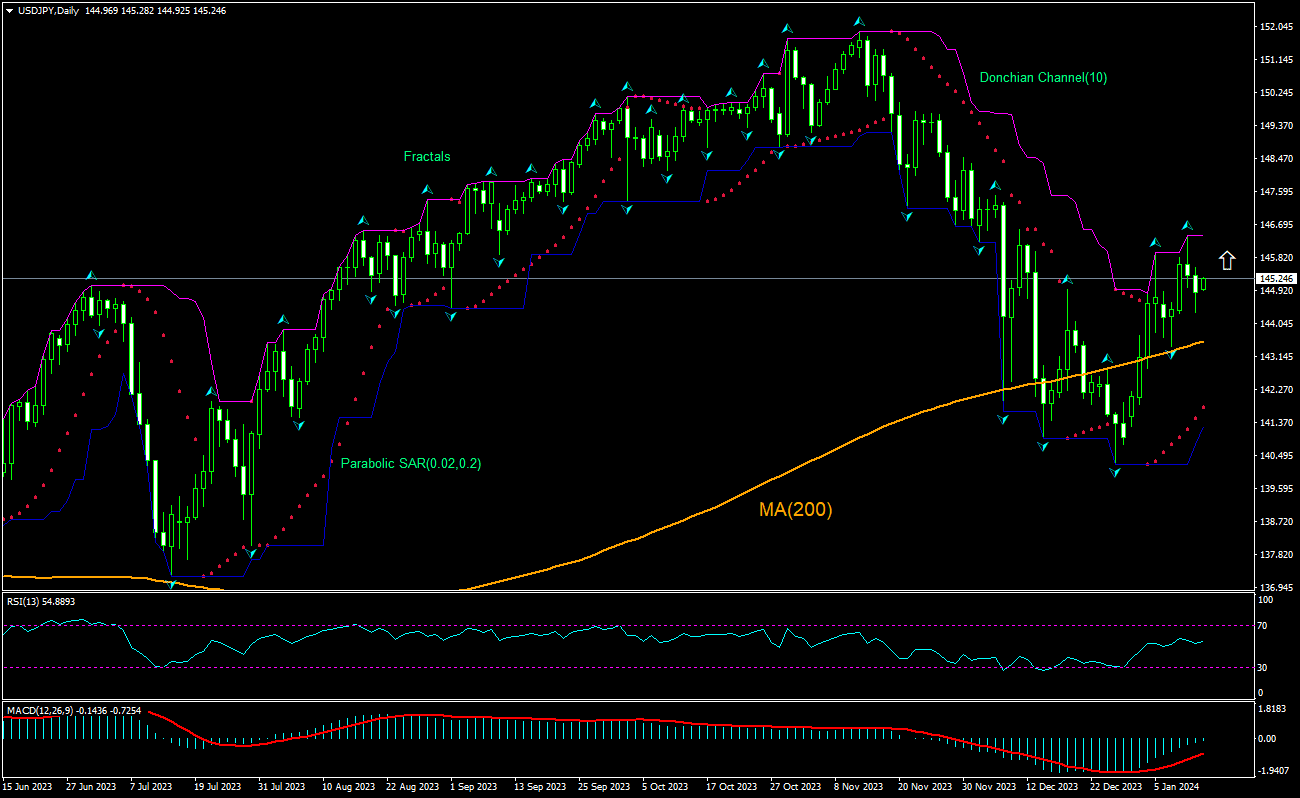

USD/JPY Technical Analysis - USD/JPY Trading: 2024-01-15

USD/JPY Technical Analysis Summary

Above 146.41

Buy Stop

Below 143.56

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

USD/JPY Chart Analysis

USD/JPY Technical Analysis

The technical analysis of the USDJPY price chart on daily timeframe shows USDJPY,Daily is retracing up above the 200-day moving average MA(200) after returning back above MA(200). We believe the bullish movement will resume after the price breaches above the upper bound of the Donchian channel at 146.41. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 143.56. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Forex - USD/JPY

Japan’s bank lending grew more than expected in December. Will the USDJPY price rebound continue?

Japan’s bank lending grew more than expected in December when a slowing was expected: the Bank of Japan reported the total value of outstanding bank loans issued to consumers and businesses rose 3.1% over year following 2.8% growth in November when a 2.7% increase was forecast. This is bullish for Japanese yen and bearish for USDJPY as rising borrowing signals higher consumer and businesses confidence preceding higher spending and economic growth. However the current setup is bullish for the USDJPY pair.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.