- 分析

- 技術分析

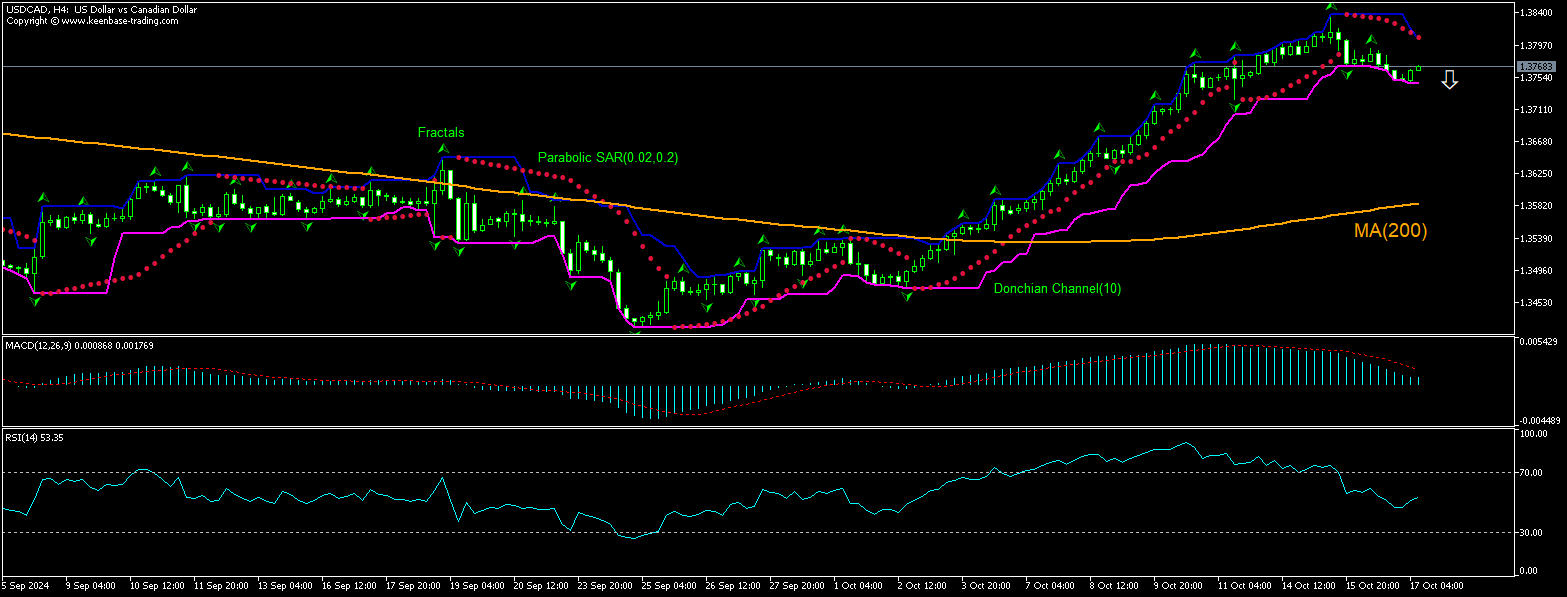

USD/CAD 技術分析 - USD/CAD 交易: 2024-10-17

USD/CAD 技術分析總結

低於 1.37462

Sell Stop

高於 1.38071

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 中和 |

| Donchian Channel | 賣出 |

| MA(200) | 買進 |

| Fractals | 賣出 |

| Parabolic SAR | 賣出 |

USD/CAD 圖表分析

USD/CAD 技術分析

The technical analysis of the USDCAD price chart on 4-hour timeframe shows USDCAD,H4 is retracing down towards the 200-period moving average MA(200) after hitting nine-week two days ago. We believe the bearish momentum will continue after the price breaches below the lower bound of the Donchian channel at 1.37462. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 1.38071. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

外匯交易 基本面分析 - USD/CAD

Canada’s Housing Starts growth resumed in September. Will the USDCAD price resume advancing?

Canada’s Housing Starts rose at a faster pace in September. Canada Mortgage and Housing Corporation (CMHC) reported the Housing Starts rate (annual) was 224 thousand in September after 213 thousand in previous month. While the rate rose, the six-month trend was bearish: the six-month moving average of the seasonally adjusted annual rate (SAAR) of total housing starts for all areas in Canada. The rise in housing starts rate is bullish for Canadian dollar and hence bearish for USDCAD pair.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.